Investing in mutual funds is a smart and accessible way to grow your wealth over time. Whether you’re new to investing or looking to diversify your portfolio, mutual funds offer a practical solution for all types of investors.

With professional management and a range of options, investing in mutual funds allows you to tap into markets you might otherwise miss. It’s a great way to take control of your financial future without the stress of picking individual stocks.

If you’re ready to explore how mutual funds can simplify your investment journey, keep reading. We’ll break down the basics and help you understand how to make the most of this powerful investment tool.

What Are Mutual Funds?

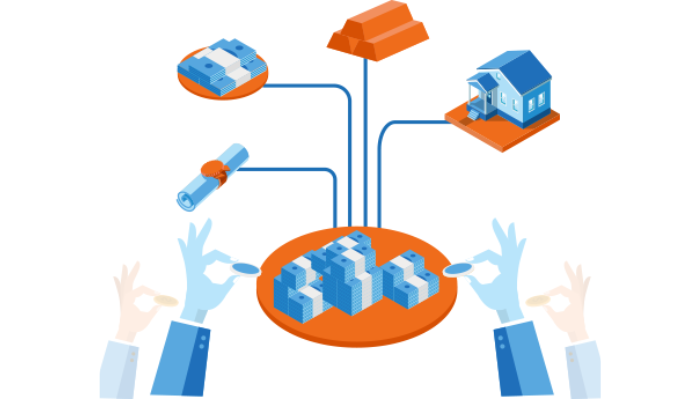

At its core, a mutual fund is a pool of money collected from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, or other securities. A professional fund manager oversees the fund, making investment decisions based on the fund’s objectives.

By investing in a mutual fund, individual investors can gain exposure to a wide range of assets without having to pick and manage them on their own.

For South Africans, mutual funds offer an excellent way to participate in local and global markets without needing to be an expert in investment management. Investing in mutual funds simplifies the process of portfolio diversification and offers a chance to grow wealth over time.

Why Consider Investing in Mutual Funds?

-

Diversification

One of the main advantages of investing in mutual funds is diversification. By pooling money with other investors, mutual funds invest in a variety of assets across different sectors and geographic regions. This reduces risk because your investment is spread out, and a downturn in one sector won’t necessarily impact the entire fund’s performance. -

Professional Management

Another significant benefit is that mutual funds are managed by experienced professionals. These fund managers have the expertise to research and select investments, making it easier for South African investors to access high-quality portfolios without needing specialized knowledge themselves. This can be especially valuable for beginners or busy individuals who may not have the time to manage their investments. -

Accessibility

Investing in mutual funds is also highly accessible. Many funds have relatively low minimum investment requirements, allowing even small investors to participate. In South Africa, there are options that cater to different financial goals and risk appetites. Whether you’re looking for low-risk, steady growth or higher returns with more risk, there’s likely a mutual fund that fits your needs. -

Affordability

When it comes to investing in mutual funds, the costs can be lower compared to other forms of investing, such as buying individual stocks or bonds. Many mutual funds charge relatively low management fees, and since they allow you to invest in a wide range of assets, you may end up saving money on trading costs too.

Understanding the Types of Mutual Funds Available in South Africa

There are several types of mutual funds available in South Africa, each catering to different investment strategies and goals. Some of the most popular types include:

-

Equity Funds

Equity funds primarily invest in stocks and shares, offering the potential for high returns over time. However, they also come with higher risk, as stock prices can fluctuate significantly. For South African investors looking to grow their wealth, equity funds can provide substantial returns in the long run, especially when investing in strong companies or emerging markets. -

Bond Funds

For those seeking more stable returns with lower risk, bond funds are an option. These funds invest in government or corporate bonds, providing regular income through interest payments. While bond funds may not offer the same high returns as equity funds, they can be an excellent choice for conservative investors looking for security and a steady income stream. -

Balanced Funds

Balanced funds are designed to provide a mix of both equities and bonds. By investing in a variety of asset classes, these funds offer a balance between risk and reward. They are ideal for South African investors who want exposure to both growth and income, with moderate risk levels. -

Index Funds

Index funds aim to replicate the performance of a specific market index, such as the JSE All Share Index. These funds are passively managed, meaning they aim to track the market rather than beat it. Investing in mutual funds through index funds is often a cost-effective way to gain exposure to the broader market while keeping fees low. -

Money Market Funds

Money market funds invest in short-term, low-risk securities such as treasury bills and certificates of deposit. These funds are considered safe and are ideal for investors who prioritize stability and liquidity over high returns. While returns are typically lower than other types of funds, they provide a secure place to park money in the short term.

How to Start Investing in Mutual Funds in South Africa

If you’re new to investing in mutual funds, the process can feel overwhelming at first. However, with the right guidance and a clear strategy, you can easily begin your investment journey.

-

Determine Your Financial Goals

Before choosing a mutual fund, take time to think about your financial goals. Are you saving for retirement, a home, or your children’s education? Understanding your objectives will help you determine which type of mutual fund is best suited to your needs. -

Understand Your Risk Tolerance

All investments carry risk, and mutual funds are no exception. Some funds, such as equity funds, are more volatile, while others, like bond or money market funds, are less risky. Assess your risk tolerance based on your investment horizon and ability to weather market fluctuations. -

Research Different Funds

Once you know your goals and risk tolerance, it’s time to research the different mutual funds available in South Africa. Look at factors like performance history, management fees, and the fund’s investment strategy. Many fund managers provide online tools to help investors compare different funds and make informed decisions. -

Open an Investment Account

To invest in mutual funds, you’ll need to open an investment account with a bank, broker, or online investment platform. Many South African banks offer platforms where you can buy and manage mutual funds. After setting up your account, you can start investing by making a lump-sum payment or setting up a recurring investment plan. -

Monitor Your Investments

Once you’ve started investing in mutual funds, it’s important to monitor your portfolio regularly. Review the performance of your funds and make adjustments if necessary. While mutual funds are generally long-term investments, it’s essential to stay informed and ensure your investments align with your evolving financial goals.

The Importance of Patience in Investing in Mutual Funds

While investing in mutual funds can provide excellent returns over time, it’s important to remember that successful investing requires patience. The value of mutual funds can fluctuate in the short term, but historically, they have proven to be profitable for long-term investors.

If you’re just starting, avoid the temptation to make frequent changes based on short-term market movements. Stay focused on your goals and let your investments grow over time.

Conclusion

Investing in mutual funds is an excellent option for South African investors looking to grow their wealth while minimizing the complexities of managing individual investments.

By choosing the right funds and maintaining a long-term perspective, you can simplify your investment journey and set yourself up for financial success.

Whether you’re interested in equity funds, bond funds, or index funds, there’s a mutual fund option suited to your needs. Take the time to educate yourself, choose wisely, and start your investment journey today!