ADVERTISEMENT

ADVERTISEMENT

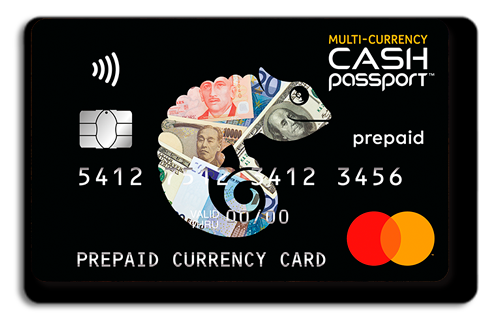

Finding the ideal No Credit Check Card can be a significant step for those with limited or poor credit history. These cards provide a unique opportunity to access the benefits of credit without the challenges of traditional checks, offering financial flexibility and convenience.

Whether you’re rebuilding your credit or seeking a straightforward payment solution, a No Credit Check Card allows you to manage your finances effectively without the fear of being denied. With accessible eligibility requirements and transparent terms, these cards open doors to financial independence.

Explore the best options available and see how they can help you take control of your financial journey!