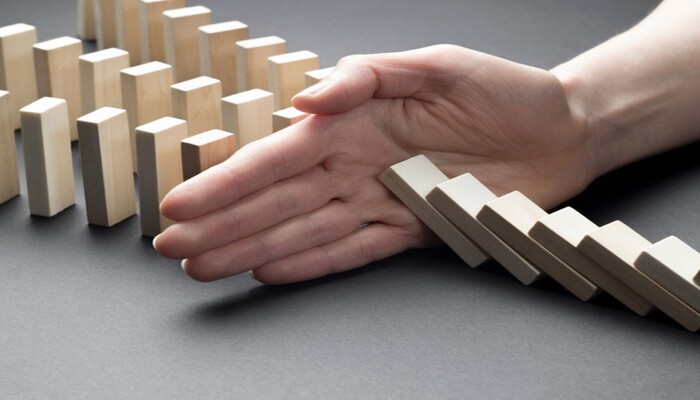

Financial management plays a vital role in overcoming tough times. When facing economic uncertainty, knowing how to manage your finances can make all the difference between surviving and thriving.

In times of crisis, many of us feel overwhelmed by the changes happening around us. However, having a solid financial strategy can ease stress and set you on the path to stability.

Want to know how to take control of your financial future even in the face of adversity? Keep reading to discover practical tips on how to manage your finances during challenging times.

The Importance of Financial Management in Crisis Situations

When crisis strikes, whether due to economic downturns, natural disasters, or political instability, the first instinct is often to panic. However, it’s during these times that financial management becomes even more critical.

In South Africa, where the economy can be volatile, financial planning is a tool for mitigating risk. For individuals, it can mean protecting personal savings, while for businesses, it involves maintaining cash flow and cutting unnecessary expenses.

One of the key aspects of financial management during a crisis is understanding the need to prioritize. With limited resources, it’s important to focus on essential spending. This means cutting down on luxuries and reallocating funds towards critical needs, such as securing food, housing, and, for businesses, maintaining operations and employee salaries.

Practical Steps for Effective Financial Management

Effective financial management during a crisis is not just about reducing spending, it’s also about smart investments and proper planning. Below are practical steps for both individuals and businesses to adopt during a crisis in South Africa:

1. Budgeting and Cash Flow Management

A clear and realistic budget is the foundation of sound financial management. Individuals should reassess their income and expenditure and create a budget that reflects their new reality. Similarly, businesses need to monitor their cash flow more closely.

In uncertain times, businesses should create a more conservative budget that accounts for possible declines in revenue and unexpected expenses.

For both individuals and businesses, the key to managing cash flow is to keep track of income and expenses regularly. Monitoring these metrics will help prevent overspending and ensure there are enough funds to cover essential costs.

2. Emergency Fund Building

In times of uncertainty, having an emergency fund can be a lifesaver. For individuals, it’s important to save at least three to six months’ worth of living expenses. This fund should be easily accessible and used only for emergencies.

For businesses, building an emergency fund is equally important. This reserve can help cover unexpected costs or losses in income, ensuring the business remains operational during difficult periods.

Emergency funds are a critical component of financial management that provide security and peace of mind in times of crisis.

3. Reducing Debt and Financial Liabilities

Reducing debt is another crucial aspect of financial management during a crisis. For individuals, high-interest debts such as credit card balances should be prioritized for repayment. Cutting down on unnecessary debt can free up resources and reduce stress.

For businesses, managing liabilities is equally vital. It might mean negotiating with suppliers, creditors, or banks for better terms, or restructuring loans to reduce financial pressure. Cutting down on non-essential costs and renegotiating terms with creditors can go a long way in ensuring long-term survival.

4. Strategic Investment Decisions

While the idea of investing during a crisis might seem counterintuitive, it can actually be a good opportunity if done wisely. The key is to adopt a conservative approach to investments and consider safer options.

Individuals may choose low-risk investments like government bonds or high-interest savings accounts, while businesses could look into diversifying their investments to protect against future risks.

The role of financial management during a crisis is to identify investment opportunities that provide returns without exposing individuals or businesses to excessive risk.

How South African Individuals Can Benefit from Financial Management

South Africa has a unique economic landscape with many individuals struggling with unemployment, inflation, and a high cost of living. The right financial management can provide South Africans with the tools they need to navigate these tough times.

By adhering to sound financial principles, individuals can make smarter decisions regarding saving, spending, and investing, ultimately improving their financial situation even during a crisis.

Financial literacy is an important component of financial management that South Africans should embrace. Many individuals in the country are not well-versed in managing finances, but the crisis has shown how critical it is to understand the basics of budgeting, saving, and investing.

Access to financial education can empower individuals to make informed choices that will safeguard their financial futures.

Business Financial Management in South Africa During Crisis

For businesses, particularly small and medium-sized enterprises (SMEs) in South Africa, financial management during a crisis is a matter of survival. The COVID-19 pandemic, for example, led to many businesses facing major challenges in maintaining operations.

Cash flow issues, disruption of supply chains, and declines in consumer spending forced many companies to rethink their strategies.

Adopting proper financial management can help businesses prepare for these unforeseen disruptions. A solid financial plan should include strategies for increasing cash reserves, cutting unnecessary costs, and diversifying income streams.

Additionally, businesses should regularly assess their financial position and make adjustments as needed to stay afloat during a crisis.

Government support programs, such as the relief funds during the COVID-19 crisis, have provided some financial aid to businesses. However, it’s important for business owners to understand that these are short-term solutions. Long-term survival depends on adopting effective financial practices and staying adaptable in the face of economic challenges.

Leveraging Technology for Financial Management

Advances in technology have made financial management more efficient and accessible. South Africans, both individuals and businesses, can now use digital tools to monitor their finances. Mobile banking apps, budget tracking software, and accounting software can provide real-time data and financial insights that were once only available to larger organizations.

For businesses, cloud-based financial management systems offer the ability to track finances from anywhere and at any time. These tools can help businesses stay on top of their budgets, manage cash flow, and make informed decisions even during a crisis.

For individuals, apps that track spending, savings goals, and investments can help monitor finances and avoid overspending. These digital tools are valuable in helping South Africans practice proactive financial management, which is essential during a crisis.

Conclusion: Building Resilience Through Financial Management

In times of crisis, financial management is not just about surviving; it’s about building resilience. By making informed decisions, planning for emergencies, and maintaining a disciplined approach to finances, South Africans can not only navigate economic challenges but also thrive in the long run.

Whether it’s budgeting effectively, building emergency funds, or strategically investing, the principles of sound financial management provide a pathway to financial security during even the most uncertain times.

Ultimately, the key to successful financial management in a crisis is staying calm, staying informed, and taking action. With the right mindset and tools, individuals and businesses in South Africa can emerge from financial crises stronger and more prepared for the future.