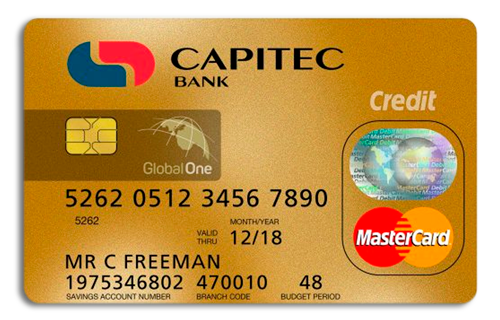

The Capitec card, a credit option offered by Capitec Bank, stands out as a financial solution that could be perfect for you! With interest-free days and a favorable credit limit, your purchases will be greatly facilitated.

With an elegant design and innovative features, the card is much more than just a means of payment, offering unmatched flexibility and convenience compared to other similar options.

This card not only facilitates your daily transactions but also provides advantages that can be enjoyed globally. Curious to know more? Keep reading and discover all the details and benefits of this incredible credit card.

About the Issuer

Capitec Bank, founded in 2001, quickly established itself as one of the most innovative and fastest-growing financial institutions in South Africa. With a customer-focused approach, Capitec aims to simplify banking services and make them accessible to everyone.

Capitec Bank offers a wide range of financial products, including current accounts, savings, and credit options. The Capitec Global One card is one of the company’s main products, standing out for its modern design and competitive benefits.

Capitec is recognized for its transparency and efficiency, making it a reliable choice for millions of South Africans seeking simplified and effective banking services.

Credit Card Benefits

Cashback on Purchases: Earn 1% cashback on all purchases made with the card, plus an extra 0.5% if you meet monthly spending goals.

Interest-Free Credit Period: Enjoy up to 55 days of interest-free credit on purchases, allowing for more flexible budget management.

Advanced Security: Capitec offers robust security features, including the ability to manage transactions and limits via the app, and a digital wallet service for secure payments.

Travel Insurance: Get up to R5 million in free travel insurance when you pay for airline tickets with the card.

Easy Management via App: Use the Capitec app to monitor transactions, set limits, and access additional services, making financial management simpler and more accessible.

Cepitec Card Fees and Comissions

The Capitec card has a monthly fee of R50.00 and also charges an initiation fee of R100. The interest rate varies based on each client’s credit profile, ranging from 11.75% to 22.25%.

It’s important to note that fees and commissions may change without prior notice, so always check the updated conditions directly on the official Capitec Bank website.

Credit card limit

The Capitec card’s credit limit can reach up to R500,000.00, depending on the client’s income and payment capacity. This substantial limit offers flexibility for large purchases and emergency expenses, ensuring you have access to credit when you need it most.

This is another great positive point of this credit card, which was developed with the main needs of consumers in mind. It is worth remembering that after contracting, the bank can still make limit adjustments.

Positive points

- Competitive Interest RateLow-interest rates for clients with a good credit history.

- Ample Credit LimitUp to R500,000.00, depending on credit evaluation.

- Cashback on Purchases1% on all purchases, with a possible bonus.

Negative points

- Income RequirementsA specific minimum income is required.

- No Travel Loyalty ProgramDoes not offer loyalty points for travel expenses.

- EligibilitySpecific requirements must be met to be approved.

How to apply for Cepitec credit card

- Check Eligibility: Access the official Capitec Bank website and check the eligibility criteria;

- Gather Documents: Valid ID, proof of income, and bank statement for the last three months;

- Fill Out the Form: Available online, in the app, or at a Capitec branch;

- Submit Documentation: Submit the necessary documents through the chosen application channel;

- Wait for Evaluation: The bank will review your application and inform you of approval and the credit limit granted;

- Activate the Card: After approval, go to a Capitec branch to activate the card and set your PIN.

How to contact Cepitec

For more information about the card, contact Capitec Bank:

- Phone: 0860 10 20 43

- WhatsApp: 097 418 9565

- In-Person: Find a bank branch for in-person service

The Capitec card offers an impressive combination of benefits, competitive fees, and advanced financial management services. Apply for yours today and start enjoying all the advantages it has to offer!