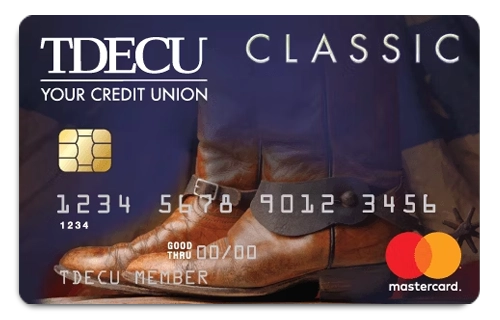

The TDECU Classic credit card is an excellent option for those who want to shop with more security and flexibility. With competitive rates and exclusive benefits, it stands out as an accessible and effective financial tool for everyday use.

This card offers an initial interest rate of 0% for purchases in the first six months, allowing you to make purchases without added interest during this period. Additionally, there is no annual fee, making it even more attractive for those looking to save.

Next, you’ll discover all the details about the TDECU Classic credit card: its issuer, the benefits offered, the applied fees, the credit limit, and how to request it without complications. Check it out!

Meet the Issuer

TDECU (Texas Dow Employees Credit Union) is a credit union based in Texas, United States, committed to offering high-quality financial services to its members.

With a solid history and a growing member base, TDECU stands out for its trustworthiness and excellence in services.

In addition to credit cards, TDECU offers a variety of financial products, including checking and savings accounts, personal and mortgage loans, catering to the diverse needs of its members.

TDECU’s mission is to improve the financial lives of its members by providing access to products and services that promote stability and financial growth.

Main Benefits of the Card

0% Initial Interest Rate for 6 Months: During the first six months, the TDECU Classic credit card offers a 0% interest rate on purchases. This allows users to enjoy credit without worrying about interest, as long as the balance is paid in full by the due date.

No Annual Fee: One of the most attractive features of the card is the absence of an annual fee. This means you can use the card without extra costs, making it an affordable option, especially for those starting to build or rebuild their credit.

25-Day Grace Period: The TDECU Classic credit card offers a grace period of up to 25 days. This means that by paying the balance in full by the due date, you will not have to pay interest on new purchases made during this period.

No Cash Advance Fee: There are no additional fees for cash advances, making the card a good option for emergencies. This flexibility to access cash without extra costs is attractive for those who need quick funds.

Access to Financial Management Tools: TDECU offers online tools to help with financial management, including spending control and due date alerts. These tools are ideal for those looking to have greater control over their finances and keep their budget balanced.

Fraud Protection: The TDECU Classic includes fraud protection, ensuring that you will not be held responsible for unauthorized transactions. This provides an extra layer of security when using the card for online and in-store purchases.

Flexible Payment Options: The card offers multiple payment methods, including online options and the app. This flexibility makes it easier to settle your bill according to your preference, making the process more convenient and accessible.

Exclusive Offers: The TDECU Classic credit card provides access to promotions and exclusive discounts for purchases at selected partners.

Global Acceptance: The TDECU Classic credit card is accepted at millions of locations worldwide due to its partnership with MasterCard. This offers great convenience for those needing a credit card for international travel or online shopping.

TDECU Classic Credit Card: Fees and Commissions

The TDECU Classic credit card has no annual fee, making it an economical option for those looking to build or rebuild credit. Interest rates range from 9.49% to 17.99%, depending on your credit profile.

Note: Fees and conditions are subject to change without prior notice. For further details, visit the official TDECU website.

Card limit

The credit limit for the TDECU Classic credit card is determined through a credit analysis, considering factors such as financial history and credit score. For clients with good credit, the limit tends to be higher, while for those with limited history, the initial limit may be lower.

This limit can be adjusted over time based on card usage and bill payments. If you wish to increase your limit, you can request a review directly with TDECU.

Positive points

- 0% Initial Interest Rate:Allows you to save during the first six months.

- No Annual Fee:Reduces costs for the cardholder.

- No Cash Advance Fee:Facilitates access to funds in emergency situations.

Negative points

- Interest Rates After the Initial Period:Rates may be high depending on your credit profile.

- Initial Credit Limit:May be limited for new applicants.

- Need for Good Credit Management:It’s essential to maintain a good payment history to enjoy the benefits.

How to Apply for Your TDECU Classic Credit Card

- Visit the official TDECU website or download the app.

- Go to the TDECU Classic credit card page.

- Click on the “Apply Now” option to start the process.

- Fill out the application form with your personal and financial information.

- Submit the required documents, such as proof of identity and residence.

- Wait for TDECU’s credit analysis.

- Once approved, wait for your card to be sent to your address.

How to Contact TDECU

For more information or assistance, contact TDECU through the following channels:

- Phone: (800) 839-1154

- FAX: (979) 299 0212

- Online Chat: Available on the official TDECU website.

Want more financial autonomy through a practical and affordable payment method? Then request your TDECU Classic credit card today and take advantage of all its benefits!