Long-term investments are essential financial strategies designed to promote substantial wealth growth over time. By focusing on asset diversification, regular portfolio evaluation, and understanding tax implications, investors can build financial security while minimizing risks. A well-structured investment plan allows for consistent returns and long-term stability.

Committing to long-term investments helps investors navigate market fluctuations with confidence. Unlike short-term strategies that rely on quick gains, long-term investing emphasizes patience and disciplined decision-making. Through consistent contributions and strategic adjustments, individuals can steadily grow their wealth while working toward financial independence.

Understanding how long-term investments work is key to making informed financial decisions. Keep reading to explore effective investment strategies, risk management techniques, and expert insights that will help you secure your financial future.

What Are Long-Term Investments?

Long-term investments are financial assets that you plan to hold for an extended period, typically more than five years. The goal of these investments is to grow your principal amount substantially over time, allowing you to achieve financial freedom. Whether it’s stocks, bonds, or real estate, the primary objective is to accumulate wealth through appreciation and compounding interest.

The Importance of Time

One of the key elements of long-term investments is the benefit of time. The longer your money is invested, the more potential it has to grow. This is due to compound interest, where the returns on your investments generate additional earnings over time. Hence, starting early can lead to significant gains.

Risk and Volatility

While long-term investments can yield high returns, they may come with risks. Market volatility can affect performance in the short term. Yet, history shows that markets tend to recover and increase in value over extended periods. Therefore, long-term investors often navigate market fluctuations with greater ease compared to short-term traders.

Strategies for Long-Term Investing

Investors use various strategies when selecting long-term investments. Some might focus on value investing, seeking undervalued stocks to hold for growth. Others might prefer growth investing, where they invest in companies poised for rapid expansion. Understanding your investment style can help you make informed decisions.

In summary, long-term investments are a crucial aspect of financial planning. By focusing on holding assets for several years, you can build wealth and attain your financial goals effectively.

Benefits of Long-Term Investments

Long-term investments offer several benefits that can significantly impact your financial future. Understanding these advantages can help you make informed decisions about your investment strategy.

Wealth Accumulation

One of the primary benefits of long-term investments is wealth accumulation. Over time, investments can grow due to compound interest. The longer you invest, the more your money can compound, leading to substantial financial growth.

Reduced Market Volatility

Long-term investors can better withstand market fluctuations. While short-term market movements can be unpredictable, a long-term perspective allows you to ride out volatility. Historical data shows that markets tend to recover and grow over extended periods.

Lower Tax Burden

Another advantage of long-term investing is potential tax benefits. In many regions, long-term capital gains tax rates are lower than short-term rates. This means you can keep more of your earnings when you hold investments for longer than a year.

Goal Alignment

Long-term investments enable you to align your investment choices with your financial goals. Whether saving for retirement, a child’s education, or a major purchase, a long-term strategy helps you build the necessary funds over time.

Less Stress and More Focus

Investing for the long term reduces the stress of constant market monitoring. By focusing on your long-term goals, you can make more rational decisions rather than reacting to daily market changes.

In summary, the benefits of long-term investments include wealth accumulation, reduced market volatility, lower tax burdens, alignment with financial goals, and less stress. By understanding these advantages, you can create a robust investment strategy that helps you achieve financial freedom.

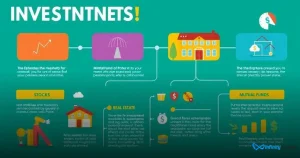

Different Types of Long-Term Investments

Different types of long-term investments offer a variety of ways for individuals to grow their wealth over time. Understanding these options can help you choose the investment route that aligns with your financial goals.

Stocks

Stocks represent ownership in a company. By purchasing shares, you invest in its potential growth. Historically, stocks have offered high returns over the long term, although they can be volatile in the short run.

Bonds

Bonds are loans made to corporations or governments. In return for your investment, bond issuers pay you interest over a specified period. Bonds are typically considered less risky than stocks, making them a popular choice for long-term investors seeking stability.

Real Estate

Investing in real estate involves purchasing property to rent out or sell for profit. Property values generally rise over time, and real estate often provides passive income through rental payments.

Mutual Funds

Mutual funds pool money from many investors to buy a diversified portfolio of stocks and bonds. They offer an easy way to diversify your investment and are managed by professionals, which can reduce the workload of individual investors.

Exchange-Traded Funds (ETFs)

Similar to mutual funds, ETFs are investment funds that hold a collection of assets. However, ETFs trade on stock exchanges like individual stocks. They offer diversification and can be a more affordable option with lower fees.

Retirement Accounts

Investing in retirement accounts, such as 401(k)s or IRAs, is another powerful strategy. These accounts offer tax benefits and allow your investments to grow tax-deferred until you withdraw them in retirement.

Commodities

Commodities include physical goods like gold, oil, and agricultural products. Investing in commodities can be a hedge against inflation and may provide diversification to your portfolio.

Index Funds

Index funds track a specific index, such as the S&P 500. They provide broad market exposure and typically have lower management fees compared to actively managed funds.

Peer-to-Peer Lending

This type of investment allows you to lend money to individuals or businesses through online platforms. You earn interest on the money lent, providing a potential source of passive income.

How to Start Evaluating Long-Term Investments

Evaluating long-term investments is crucial for ensuring that your financial goals align with your investment choices. Here are some steps to help you get started.

Define Your Financial Goals

Start by setting clear financial goals. Ask yourself what you want to achieve with your investments. Are you saving for retirement, a home, or education? Having specific goals provides direction for your evaluation process.

Assess Your Risk Tolerance

Understanding your risk tolerance is key. Are you comfortable with the possibility of losing some of your investment? Knowing your risk level helps you choose investments suited to your comfort zone.

Research Investment Options

Take the time to research different types of long-term investments. Look into stocks, bonds, mutual funds, and real estate. Each option has its benefits and risks, so ensure you understand them fully.

Analyze Historical Performance

Study the historical performance of your potential investments. Reviewing past performance can provide insights into how these investments have fared over time. However, remember that past results do not guarantee future returns.

Consider Market Trends

Keep an eye on current market trends that may affect your investments. Knowing the economic conditions can help you make informed decisions about whether to invest in a specific sector or asset.

Diversify Your Portfolio

Avoid putting all your eggs in one basket by diversifying your portfolio. Invest in different asset classes to spread risk. This means combining stocks, bonds, real estate, and more to balance potential losses with gains.

Review Costs and Fees

Pay attention to any costs or fees associated with investments. High management fees can eat into your returns over time. Look for low-cost investment options that still meet your needs.

Regularly Reassess Your Investments

After investing, continually reassess your portfolio. Regularly reviewing your investments helps you determine whether they still align with your financial goals and risk tolerance.

Consult a Financial Advisor

If you’re unsure about your decisions, consider consulting a financial advisor. They can provide personalized guidance based on your specific financial situation and goals.

Common Mistakes to Avoid in Long-Term Investing

Avoiding common mistakes in long-term investing can help secure your financial goals. Here are some pitfalls to watch out for:

1. Lack of Planning

Failing to create a comprehensive investment plan can lead to confusion. Identify your financial goals, risk tolerance, and timeline before investing. Having a clear plan helps you make better decisions.

2. Emotional Investing

Letting emotions drive your investment choices can be harmful. Fear and greed often lead to poor decisions. Stick to your long-term strategy and avoid making impulsive moves based on market fluctuations.

3. Ignoring Diversification

Putting all your money into one investment can increase risk. Diversifying your portfolio by investing in various asset classes helps distribute risk and improve potential returns.

4. Timing the Market

Many investors try to buy low and sell high. However, market timing is extremely difficult and often leads to losses. Instead, focus on a long-term investment strategy and regularly contribute to your portfolio.

5. Underestimating Costs and Fees

Investment fees can add up and reduce your overall returns. Always review the fees associated with your investments and look for low-cost options when possible.

6. Neglecting Ongoing Education

The financial world is constantly changing. Failing to stay informed about market trends, economic conditions, and new investment vehicles can hinder your success. Make time for ongoing education and research.

7. Not Reviewing Your Portfolio Regularly

Neglecting to review your investment portfolio can lead to missed opportunities. At least once a year, reassess your investments to ensure they still align with your goals and risk tolerance.

8. Following the Herd

Investing based solely on what others are doing can be risky. Instead, make informed decisions based on your own research and financial plan. Trust your judgment rather than following trends.

9. Overreacting to Market News

Constantly reacting to market news can lead to unnecessary changes in your strategy. Focus on long-term performance rather than short-term noise, and remember that markets fluctuate.

By being aware of these common mistakes, you can make wiser investment decisions that align with your long-term financial goals.

Strategies for Successful Long-Term Investing

Successful long-term investing requires careful planning and execution. Here are effective strategies to help you achieve your financial goals:

1. Start Early

The sooner you start investing, the more time your money has to grow. Early investments benefit from the power of compound interest, which can significantly increase your wealth over time.

2. Set Clear Goals

Establishing clear financial goals is essential. Identify what you want to accomplish with your investments—whether it’s saving for retirement, education, or a major purchase. This clarity will guide your investment choices.

3. Diversify Your Portfolio

Diversification helps reduce risk by spreading your investments across different asset classes, such as stocks, bonds, and real estate. A well-diversified portfolio can protect you from significant losses.

4. Invest in Index Funds

Index funds track a specific market index, offering broad market exposure with relatively low fees. They are an excellent option for long-term investors seeking steady growth without constant management.

5. Focus on Quality

Invest in high-quality companies with strong fundamentals. Look for businesses with a history of profitability, solid management, and a competitive advantage in their industry.

6. Stay Consistent

Consistent investing is crucial. Consider setting up automatic contributions to your investment accounts. Even small, regular investments can lead to substantial growth over time.

7. Avoid Market Timing

Trying to time the market is risky. Instead of reacting to short-term fluctuations, stick to your long-term strategy and remain invested, allowing your portfolio to grow steadily.

8. Monitor Your Investments

Regularly reviewing your investment portfolio helps ensure it aligns with your goals. Set aside time to assess your holdings, but avoid making impulsive changes based on market noise.

9. Educate Yourself

Continuous learning is vital for long-term investors. Stay informed about market trends, investment strategies, and economic changes that may affect your portfolio.

10. Consult a Financial Advisor

If you’re unsure about your investment choices, consider seeking advice from a financial advisor. They can provide personalized guidance based on your unique financial situation and help you map out a successful investment strategy.

The Role of Diversification in Long-Term Investments

Diversification plays a crucial role in long-term investments. By spreading your investments across various asset classes, you can reduce risk and enhance potential returns. Here are some key points to understand about diversification:

1. Reducing Risk

Diversification helps mitigate risk. If one investment performs poorly, others may perform well, balancing your overall portfolio. This strategy helps protect your finances during market downturns.

2. Different Asset Classes

Diversifying your investments means choosing different asset classes, such as stocks, bonds, real estate, and cash. Each asset class behaves differently under various market conditions, which adds stability to your portfolio.

3. Geographical Diversification

Investing in different geographical regions can also enhance diversification. Markets around the world may not move in tandem, meaning some areas may grow while others decline.

4. Sector Diversification

Diversifying across different sectors (like technology, healthcare, and finance) can reduce the impact of poor performance in any single industry. Balanced investments across sectors allow for better growth opportunities.

5. Time Horizon

Consider your investment timeline when diversifying. Younger investors may prioritize growth-oriented assets, while older investors might focus on stability. Tailoring diversification to your life stage can optimize returns.

6. Systematic Investment Plan

Using a systematic investment plan (SIP) can aid diversification. Regularly contributing to different investments allows for dollar-cost averaging, spreading out the risk over time.

7. Regular Portfolio Review

Reviewing your portfolio periodically helps ensure that your diversification strategy is still aligned with your financial goals. Economic and market changes may require adjustments to your asset allocation.

8. Avoid Over-Diversification

While diversification is essential, over-diversifying can lead to diminished returns. Holding too many investments can make it hard to track performance and can dilute overall gains.

In summary, effective diversification is vital for long-term investing success. By spreading your investments wisely, you can create a balanced portfolio that supports your financial goals while minimizing risks.

Tax Considerations for Long-Term Investors

Tax considerations are critical for long-term investors to understand in order to maximize their investment returns. Here are some important points to keep in mind:

1. Long-Term Capital Gains Tax

Investments held for more than one year are typically taxed at the long-term capital gains rate, which is lower than the short-term rate. This can significantly impact your overall tax burden when selling your assets.

2. Short-Term Capital Gains Tax

Assets held for less than a year are subject to short-term capital gains tax, which is taxed at your ordinary income tax rate. Avoiding this by holding investments longer can result in tax savings.

3. Tax-Advantaged Accounts

Utilizing tax-advantaged accounts like IRAs and 401(k)s can provide benefits. Contributions are often tax-deductible, and taxes on gains are deferred until withdrawal, potentially lowering your taxes in retirement.

4. Dividend Taxation

Qualified dividends from stocks held for over 60 days are generally taxed at long-term capital gains rates. Being aware of the dividend tax treatment can help you plan your investment strategy effectively.

5. Tax-Loss Harvesting

Tax-loss harvesting involves selling underperforming investments to offset capital gains elsewhere in your portfolio. This strategy can lower your taxable income and provide opportunities for tax savings.

6. Estate Planning Considerations

Understanding how long-term investments impact estate taxes is crucial. Tax laws regarding inheritances can affect how your investments are passed on to beneficiaries, so consult a professional if necessary.

7. Consult a Tax Professional

Tax laws can be complex and subject to change. Regularly consulting with a tax professional ensures you stay updated on the latest regulations that affect long-term investments and your overall tax strategy.

By considering these tax implications, long-term investors can enhance their investment returns while ensuring compliance with relevant tax laws.

Evaluating Your Long-Term Investment Portfolio

Evaluating your long-term investment portfolio is essential for ensuring it meets your financial goals. Here are key steps to consider:

1. Review Your Investment Goals

Start by revisiting your initial investment goals. Are you saving for retirement, buying a home, or funding education? Ensure your portfolio aligns with these objectives and adjust if necessary.

2. Analyze Performance

Examine how each investment has performed over time. Compare your returns against relevant benchmarks or indices to determine if your investments are meeting expectations.

3. Check Asset Allocation

Assess the current asset allocation of your portfolio. Ensure that it maintains a balance between stocks, bonds, and other assets according to your risk tolerance and investment timeline.

4. Diversification Assessment

Evaluate the diversification of your portfolio. Are you spread across different asset classes, sectors, and geographical areas? Proper diversification can lower risk and improve potential returns.

5. Watch for High Fees

Review any fees associated with your investments. High costs can diminish your returns over time. Consider switching to lower-cost alternatives if screening reveals excessive fees.

6. Consider Market Trends

Stay informed about market trends that may impact your investments. Understanding the economic environment helps you make more informed decisions about potential adjustments to your portfolio.

7. Set a Review Schedule

Establish a regular schedule for evaluating your portfolio. Whether annually or semi-annually, consistent reviews help you stay on track to meet your financial goals.

8. Rebalance as Necessary

As markets fluctuate, your asset allocation may drift from your original plan. Rebalancing involves adjusting your portfolio to bring it back in line with your investment strategy.

9. Seek Professional Advice

If you find the evaluation process overwhelming, consider consulting a financial advisor. They can provide expert insights and assist you in making data-driven investment decisions.

By regularly evaluating your long-term investment portfolio, you can optimize your strategy and work towards achieving your financial objectives more effectively.

Embrace Long-Term Investment Strategies

Long-term investments offer a powerful pathway to financial freedom and wealth accumulation. By understanding the different types of long-term investments, recognizing the benefits, and avoiding common mistakes, you set yourself up for success.

Implementing effective strategies and ensuring diversification can help you navigate market fluctuations while minimizing risks. Additionally, being aware of tax considerations will optimize your investment returns.

By regularly evaluating your portfolio and adjusting your strategy as needed, you can remain aligned with your financial goals. Remember, investing is a journey. The key is to stay informed, be patient, and commit to your long-term vision.

Don’t underestimate the impact of consistent and strategic investing in achieving your financial goals.

Check out our article on Retirement Investment to learn strategies for building a secure financial future and ensuring a comfortable retirement.